If you've been holding Amex Membership Rewards points with dreams of Emirates Business or First Class, I've got some disappointing news. American Express UK has just announced yet another devaluation to the Emirates Skywards transfer partnership, and this one stings.

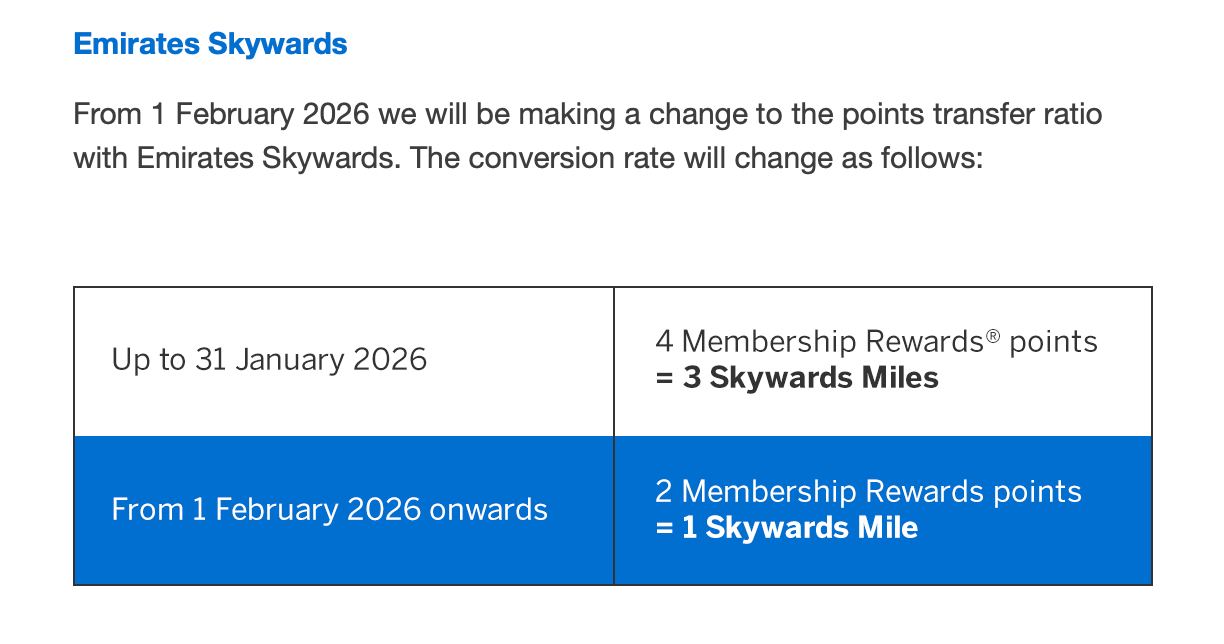

From 1st February 2026, the transfer rate will drop from the current 4:3 ratio (four Membership Rewards points for three Skywards miles) to a painful 2:1 ratio (two points for just one mile). That's a 33% reduction from where we are today, and a whopping 50% devaluation from the original 1:1 rate we enjoyed until August 2024.

What This Actually Means for Your Points

Let me put this into perspective with some real numbers. Say you wanted to book Emirates Business Class from London to Dubai, which typically costs around 87,000 Skywards miles one-way:

Under the original 1:1 rate (pre-August 2024): 87,000 MR points needed

Current 4:3 rate: 116,000 MR points needed

New 2:1 rate (from February 2026): 174,000 MR points needed

That's double what you'd have needed less than two years ago. And when you factor in the eye-watering fuel surcharges Emirates loads onto award tickets (often £400+ each way from the UK), the value proposition becomes seriously questionable.

That's double what you'd have needed less than two years ago. And when you factor in the eye-watering fuel surcharges Emirates loads onto award tickets (often £400+ each way from the UK), the value proposition becomes seriously questionable.

A Pattern of Decline

This isn't happening in isolation. Emirates has been systematically making their programme less attractive throughout 2024 and 2025:

August 2024: Amex UK moved from 1:1 to 4:3

May 2025: Emirates restricted First Class awards to Skywards elite members only (no more First Class bookings for Blue members)

September 2025: US Amex moved from 1:1 to 5:4

October 2025: Chase US removed Emirates as a transfer partner entirely

January 2026: Capital One US moving to 4:3

February 2026: UK Amex dropping to 2:1

Speaking to industry executives, the rationale seems to be about maintaining exclusivity. Emirates wants their premium cabins filled with genuine frequent flyers and those who engage directly with Skywards, rather than points collectors who transfer in miles for a one-off redemption and never fly Emirates again. From a commercial standpoint, I understand it. From a points enthusiast's perspective, it's frustrating to watch.

Should You Transfer Before February?

This is the question everyone's asking. Here's my honest take: only if you have a specific redemption in mind.

Remember that Emirates Skywards miles expire after just three years, with no easy way to extend them through account activity like Avios. Transferring speculatively could leave you watching your miles disappear if you don't book something concrete.

If you DO have a trip planned and can find award availability (which is increasingly rare in premium cabins), then yes, transferring at the current 4:3 rate makes sense. You'll get 33% more miles for your points than you would after February.

But here's the thing: Emirates isn't the only option for your Membership Rewards points, and frankly, it's becoming one of the weaker ones.

Better Alternatives for UK Amex Cardholders

Membership Rewards still transfers at 1:1 to several valuable programmes. If you're holding an Amex Gold or Platinum card, these are where I'd focus:

Avios (British Airways, Qatar Airways, Iberia, Aer Lingus, Vueling): Still 1:1. This remains the most versatile option for UK travellers, with access to multiple carriers and decent award pricing to most destinations. Plus, Avios don't expire as long as you have some account activity every 36 months.

Virgin Atlantic Flying Club: Still 1:1. Excellent for transatlantic travel, Delta partnerships, and they've been steadily improving their award availability. Check out our guide to Virgin Atlantic credit cards if you want to earn Virgin Points directly.

Cathay Pacific Asia Miles: Still 1:1. One of the best programmes for premium cabin awards to Asia and Australasia.

Etihad Guest: Still 1:1. Often overlooked, but they can have reasonable redemption rates and partner with plenty of airlines.

If you're specifically trying to reach Dubai or the Middle East, consider that British Airways/Qatar Airways flies to Dubai and you can redeem Avios at much lower surcharges than Emirates charges. Use our Avios calculator to see what you'd need.

The New Statement Credit Option

Alongside this devaluation news, Amex has quietly introduced a new way to use your Membership Rewards points: statement credits.

The rate is 1,000 MR points = £4.50. That values each point at just 0.45p, which is pretty poor compared to transferring to airline partners where you can typically achieve 0.8p-1.5p per point with good redemptions.

The minimum redemption is 200 points against eligible transactions. I'd only recommend using this option for small leftover balances or if you genuinely have no travel plans. For most people, airline and hotel transfers will deliver significantly better value.

My Thoughts

This devaluation reinforces something I've believed for a while: Emirates Skywards is becoming a programme best suited for those who fly Emirates frequently on paid tickets, not points collectors looking to transfer in.

With the First Class restriction for non-elite members, punishing fuel surcharges, difficult award availability, and now transfer rates that require double the points they did two years ago, the Emirates dream is increasingly expensive to chase.

I'd suggest most UK Amex cardholders are better served focusing on Avios or Virgin Points for their long-haul aspirations. Both programmes offer better availability, more reasonable surcharges, and partnerships that actually work in your favour.

If you're not sure where to start with UK credit cards, check out our guide to the best Avios-earning credit cards. And if you're running a business, our business credit card recommendations can help you earn points on your everyday spending.

Have you been affected by this change? Were you planning an Emirates redemption? Let me know your thoughts.

Jack