Hello, Adventurous Travellers, and Happy Thursday!

Today, we’re diving into the world of Virgin Atlantic’s incredible credit card options. Let’s look at how these new offerings can boost your travel game.

Let's get started:

✈️ New Routes Announced by Virgin Atlantic for Summer 2025: Discover the three new routes from Heathrow.

🎟️ Virgin Atlantic Reward Credit Card Vs the Virgin Reward+ Credit Card: Is it worth having one, and which one is right for you?

✈️ New Routes Announced by Virgin Atlantic for Summer 2025

We recently covered British Airways’ new summer 2025 routes. Virgin will also fly new routes from Heathrow.

Three new routes will be available from Heathrow, giving even more long-haul flight options and ways to redeem your Virgin miles.

Virgin Atlantic will launch two new routes from 30th March 2025. The first ever daily service to Riyadh, Saudi Arabia, will start, and a daily service to Toronto, Canada, will begin again after over a decade.

For the first time since 2013, Virgin Atlantic will resume flights to Accra, Ghana, starting in May 2025 to meet high demand.

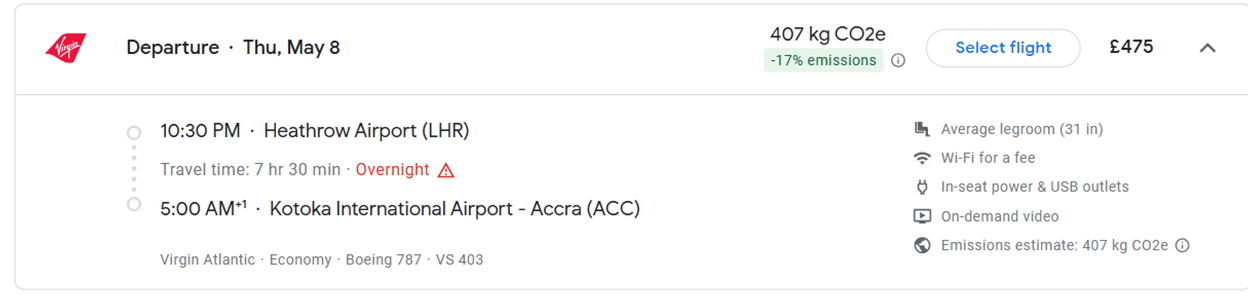

The Smart Redemptions Extension shows most economy flights to Ghana being sold for £475 one way:

Premium Economy is being sold at £1273 and business at £2079. Prices vary by date.

🎟️ The Virgin Credit Cards: Is it Worth Having One?

If you haven't yet applied for a credit card that can earn you miles, it's time to make the swap.

The Virgin Atlantic credit cards are a great choice if you want to redeem points on Virgin flights or if you fly with other Skyteam alliance airlines.

Having a Virgin Atlantic Credit Card means you can earn air miles on day-to-day spending and benefit from bonuses. Any airline credit card is one of the best ways to earn lots of air miles.

Other good options include the AMEX cards (especially the Avios ones) and the Barclaycard Credit Cards.

Virgin Atlantic has two credit cards available. The paid version is more affordable than lots of premium credit cards. It has a fee of £160 per year.

Both cards have the potential to earn an upgrade or companion ticket, but the minimum spend is £10,000 for the premium card compared to £20,000 for the free card to earn the bonus reward.

Here are the two options:

Choosing between the Virgin Atlantic Reward Credit Card and the Reward+ Credit Card largely depends on your travel habits and how quickly you want to accumulate points.

💳 Virgin Atlantic Reward Credit Card

If you're just starting to earn air miles or don't want to commit to an annual fee, the Virgin Atlantic Reward Credit Card is a no-brainer. You'll still earn points on everyday spending and benefit from potential upgrades or companion tickets.

💳 Virgin Atlantic Reward+ Credit Card

This card is perfect if you're a frequent traveller and want to earn Virgin Points Quickly. It offers higher rewards on spending and a generous welcome bonus of 18,000 points with your first purchase (6x the 3000 points bonus with the free card).

The higher points-per-pound earning rate and the substantial welcome bonus make it a smart investment for those who can take full advantage of the £160 annual fee.

Here’s a comparison of the two cards:

Virgin Atlantic Reward Credit Card | Virgin Atlantic Reward+ Credit Card | |

Virgin Points on Everyday Purchases | 0.75 points per £1 spent | 1.5 points per £1 spent |

Virgin Points on Virgin Purchases | 1.5 points per £1 spent | 3 points per £1 spent |

Bonus Points | 3,000 points with your first purchase (within 90 days) | 18,000 points with your first purchase (within 90 days) |

Representative APR | 26.9% APR (variable) | 69.7% APR (variable) |

Rewards | Spend £20,000 in 12 months | Spend £10,000 in 12 months |

Other Card Benefits

The Virgin Card is the only travel rewards credit card which offers a partial respite on FX fees when travelling.

Your credit limit caps the number of points you can earn per month.

Virgin Atlantic allows you to redeem points for flights on its own network and across the SkyTeam alliance. This doesn't apply to the 2-4-1 ticket.

🎁 Redemptions

If you spend £1000 each month, you will earn 9,000 points per year with the free card and 18,000 with the paid card.

Remember, there are other ways to top up your Virgin Points balance, including with Tesco Clubcard (1 point = 2 Virgin points), Heathrow Rewards (1:1) and hotel loyalty scheme transfers.

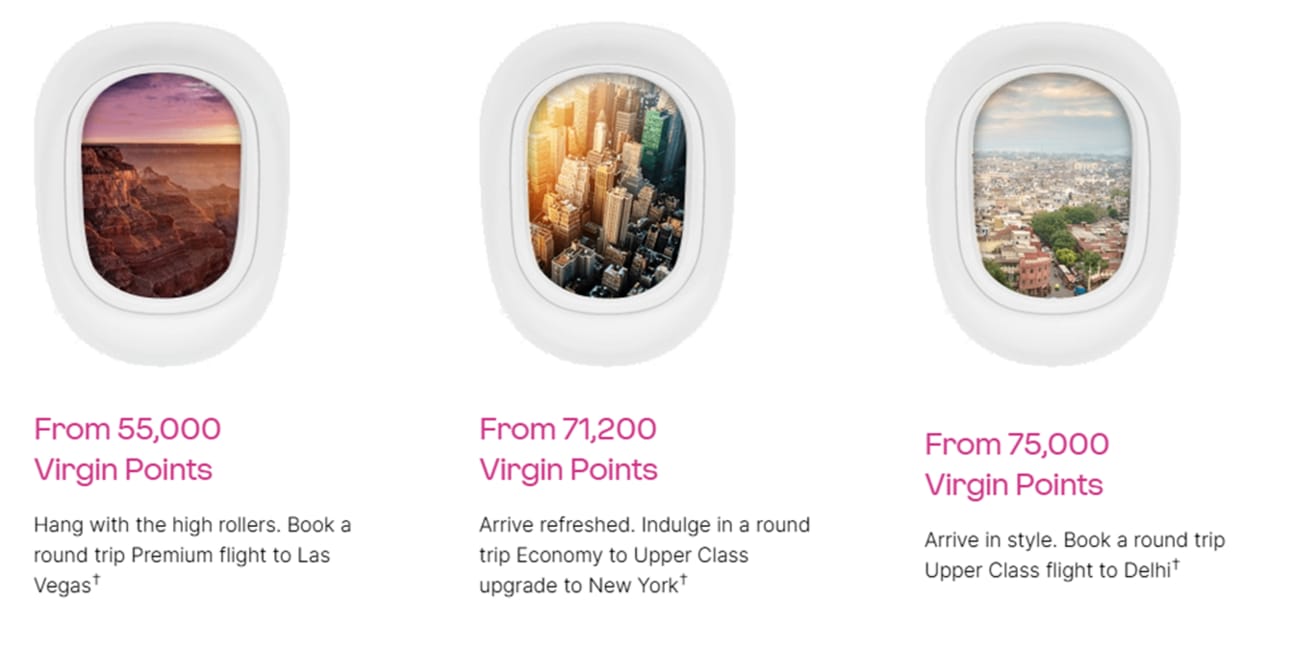

Here's what you could do with the points you earn!

You can view current reward seat deals on the website:

Remember, you don't have to spend your Virgin Points on redemptions. Points can also be spent on:

Seat upgrades

Virgin Holidays

The Virgin Atlantic Duty Free Shop

Donations

Reward flights with SkyTeam partners and other airline partners

And More…

🔑 Our Thoughts

The Virgin Cards are even more valuable if you already hold status with Virgin. You should either already have at least Silver status or actively be working towards it, especially if you want to redeem in Upper Class or use your reward for a Clubhouse pass.

With the paid card, you earn double the number of Virgin points. The £160 yearly fee is worth it if you're a higher spender. However, if you spend £20,000 each year, you can still get the upgrade bonus even without the paid card, and you'll get double the number of Virgin Points. You can also transfer AMEX Membership Rewards at 1:1.

If you want to be flexible with what you use your points for, the AMEX credit cards are a better option. You can choose to transfer your points to Avios, to hotel loyalty programmes or to Virgin. However, if you travel a lot with Virgin, the premium card will earn you more Virgin points.

Final Words

That’s all for this week! We hope these tips help you maximise your travel rewards and have better experiences.

Safe travels, and always aim for the upgrade!

Want to continue the conversation? Come and join our free Facebook group.

Bye for now!