Hilton and Currensea have partnered to launch two new debit cards for UK residents, offering a fresh way to earn Hilton Honors points on everyday spending. The cards integrate with your existing bank account and come with instant hotel status, making them an interesting option for those looking to boost their Hilton points balance.

Let's look at what each card offers:

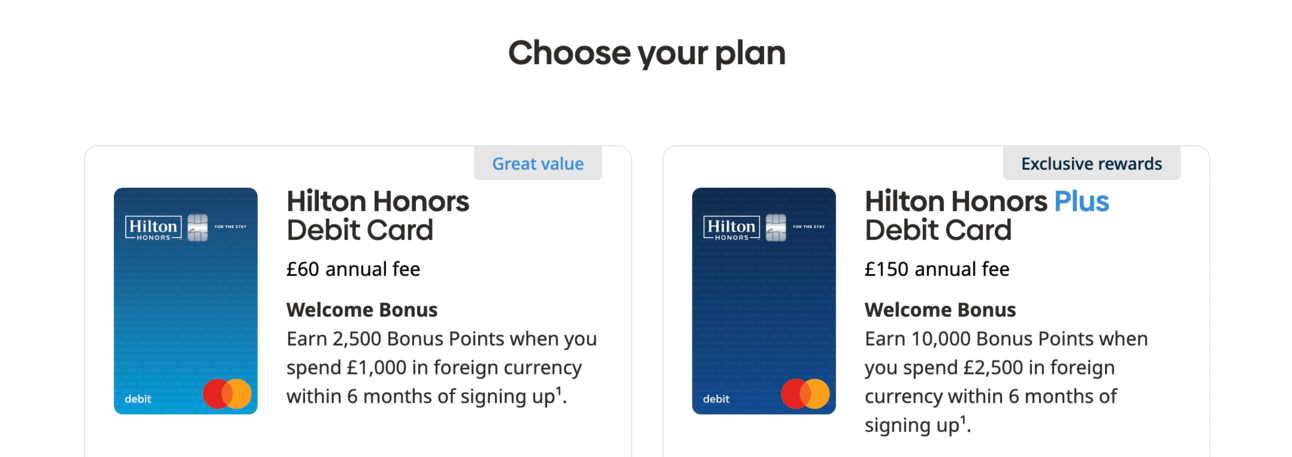

Hilton Honors Debit Card (£60 annual fee)

Welcome bonus: 2,500 Hilton points after £1,000 foreign currency spend in 6 months

Earn up to 3 Hilton points per £1 on eligible purchases

Instant Hilton Honors Silver status

0.5% FX fees on foreign transactions

ATM withdrawals abroad: 0.5% fee (2.5% over £250 per month)

Hilton Honors Debit Card Plus (£150 annual fee)

Welcome bonus: 10,000 Hilton points after £2,500 foreign currency spend in 6 months

Earn up to 4.5 Hilton points per £1 on eligible purchases

Instant Hilton Honors Gold status

No FX fees on foreign transactions

Fee-free ATM withdrawals abroad (2.5% over £500 per month)

Both cards feature a unique "Point Booster" that earns 1 Hilton point for every 1p rounded up on purchases.

The cards work with most major UK banks including Barclays, HSBC, Nationwide, Monzo, Starling and more. Setup is handled through their app, with both Google Pay and Apple Pay support available.

My Thoughts: The immediate Gold status from the Plus card is the standout feature, particularly valuable if you don't already have it through other means like the American Express Platinum Card. For frequent Hilton guests, this alone could justify the annual fee, giving you benefits like room upgrades and breakfast at properties worldwide.

The foreign transaction fees (or lack thereof on the Plus card) are competitive with other travel cards, making these a solid option for overseas spending.

However, the annual fees are significant, especially for the Plus card. You'll need to carefully consider your spending patterns and how much you value Hilton points to determine if either card makes sense for you. It's also worth noting that not all purchases will be eligible for points earning - be sure to check the terms and conditions for specifics.

These cards could be particularly appealing if you:

Don't currently have Hilton status

Make regular foreign currency transactions

Prefer using debit over credit cards

Want to earn hotel points on everyday spending

Remember, if you're primarily interested in earning travel rewards, traditional credit cards might offer better value - check out our guide to The Best Avios Earning Credit Cards in the UK for comparison.

The addition of these cards to the UK market provides an interesting new option for earning hotel points, especially for those who prefer debit cards or want to diversify their points earning strategy beyond credit cards.